annual federal gift tax exclusion 2022

The specific amount is known as the annual gift exclusion. After 2021 the 15000 exclusion may be increased for inflation.

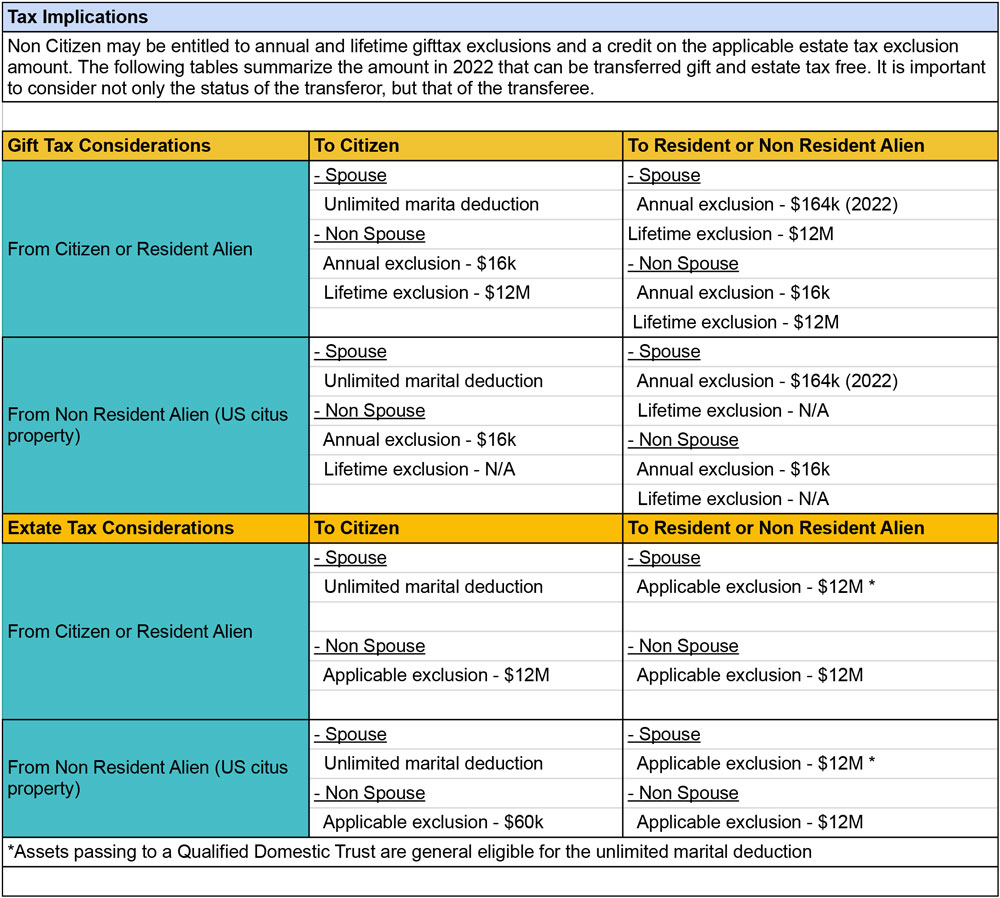

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

If you want to avoid paying the gift tax stay below the annual exclusion amount which is 16000 in 2022 up from 15000 in 2021.

. The gift tax exclusion for 2022 is 16000 per recipient. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary. The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to 14890 up from 14440 for 2021.

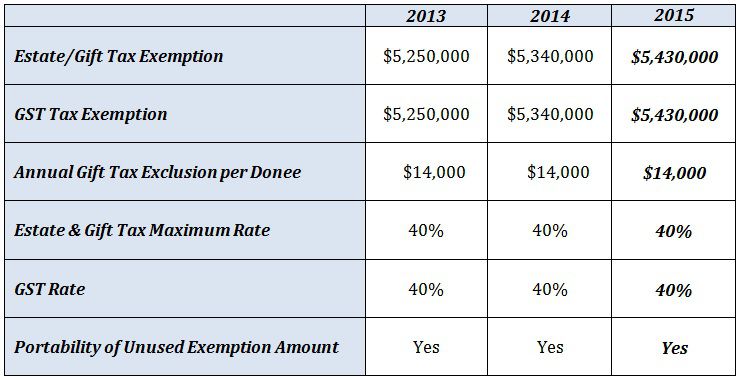

The annual exclusion for 2014 2015 2016 and 2017 is 14000. The annual exclusion is the aggregate amount of present interest gifts that can be given without using lifetime gift tax exemption. Any gift above the.

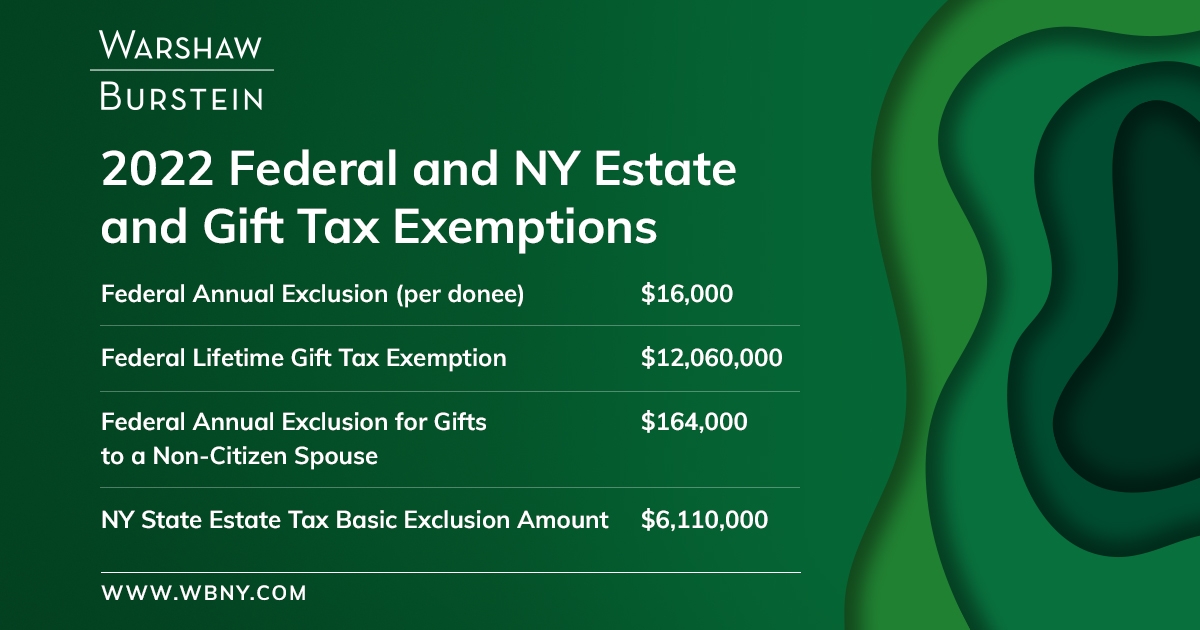

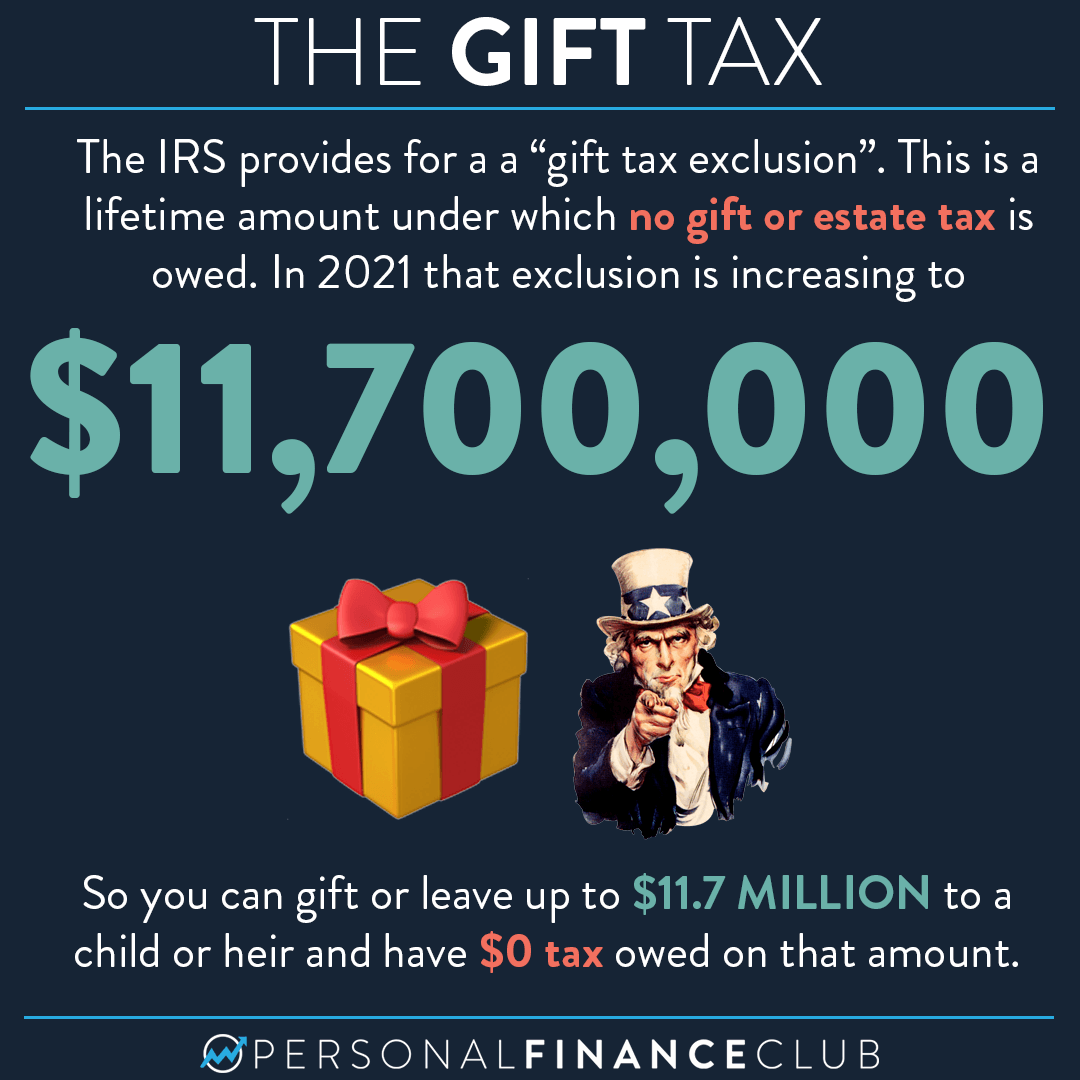

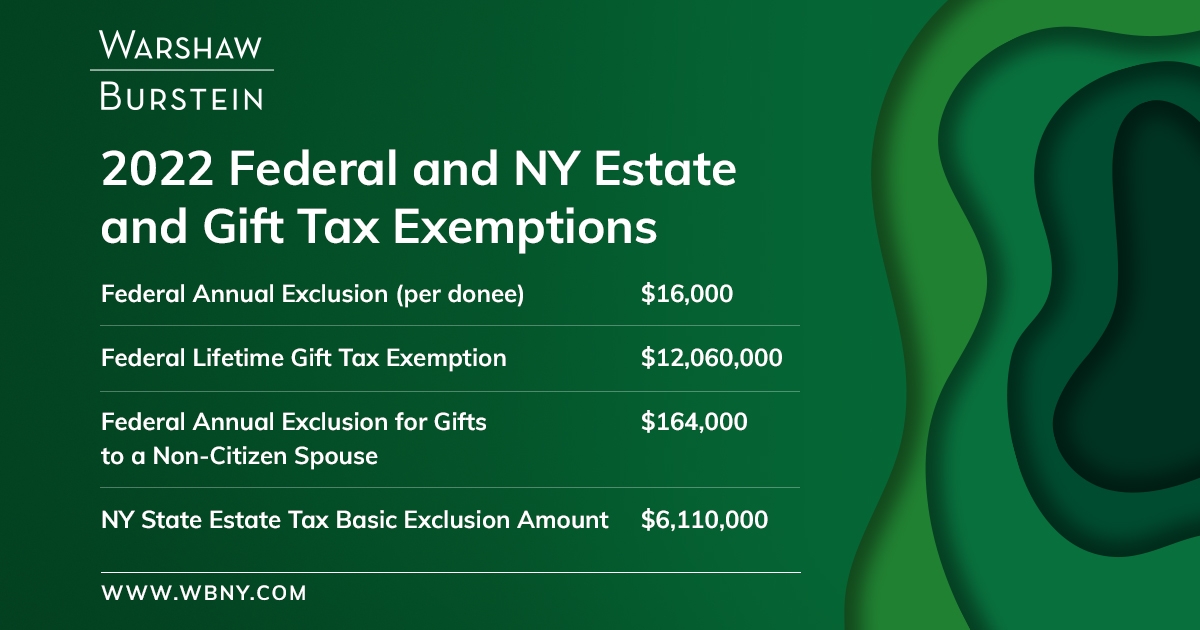

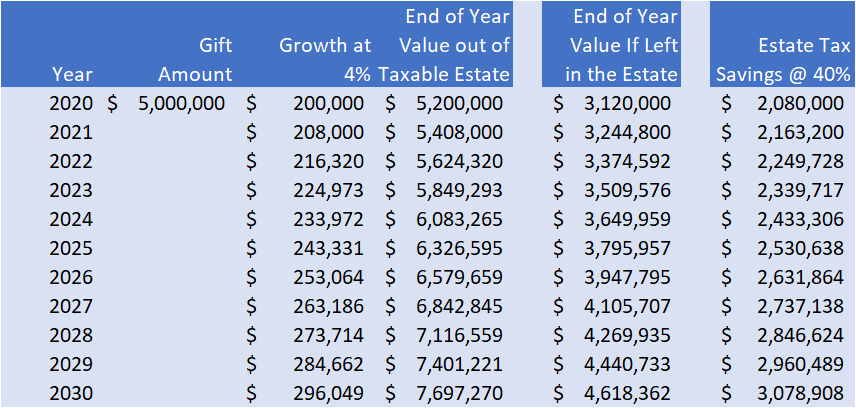

The gift tax return is due april 15 after the year you exceeded the annual exclusion. As the gift tax exemption is the amount each individual can give spouses can each gift up to. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021.

The gift tax exclusion for 2022 is 16000 per recipient. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. This increase to the federal estate and gift exemption amount to 12060000 means that estates of individuals who die in 2022 with combined.

You can give up to this amount in money or property to any individual per year without incurring a gift tax. 13 rows Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of assets. The IRS generally isnt involved unless a gift exceeds 15000 16000 in 2022.

The annual exclusion applies to gifts to each donee. The federal estate tax exclusion is also climbing to more than 12 million per individual. This means that any taxable amount exceeding the.

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. Few people owe gift tax. The annual federal gift tax exclusion allows you to give away up to 15000 each in 2021 to as many people as you wish without those gifts counting against your 117 million lifetime exemption.

For 2022 the annual gift exclusion is being increased to 16000. That tax is usually paid by the donor the giver of the gift. The federal estate tax exclusion is also climbing to more than 12 million per individual.

Annual Gift Tax Limits. Any gift above the exclusion is subject to. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017.

Is There a Way to Avoid Paying the Gift Tax. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

Even then it might only trigger extra paperwork. For 2018 2019 2020 and 2021 the annual exclusion is. Any person who gives away.

The annual gift exclusion is applied to each donee. For the past four years the annual gift exclusion has been 15000. You never have to pay taxes on gifts that.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. News Release IR-2021-216 IRS announces 401k limit increases to 20500. For the first time in several years the annual exclusion from gift tax will increase from 15000 to 16000 per year per donee effective January 1.

In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. Itll also limit the.

Gifts that are worth more than that amount will have to be included in your gift tax return filing. The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax.

The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. Increase of Annual Gift Tax and Estate Tax Exclusions in 2022. We Help Taxpayers Get Relief From IRS Back Taxes.

1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your brother your sister your new best friends youll have lots of friends if you start giving away free money and you wouldnt have to pay a gift tax. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary. If gifts are made through a trust the trust must be written to include crummey withdrawal power to qualify as a current.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. Do you pay taxes when you receive a gift. 13 rows The gift tax rate for 2022 is 18-40.

In 2022 the annual exclusion is 16000. Many clients make annual exclusion gifts directly to their children and. The IRS also increased the annual exclusion for gifts to 16000 in 2022 up from 15000.

The exclusion amount for 2021 is 15000. Gifts to beneficiaries are eligible for the annual exclusion. The federal government imposes a tax on gifts.

Ad Based On Circumstances You May Already Qualify For Tax Relief. In 2018 2019 2020 and 2021 the annual exclusion is 15000.

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Opportunity Is Still Knocking Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Pierrolaw

Gift Tax How Much Is It And Who Pays It

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Does The Gift Tax Work Personal Finance Club

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Warshaw Burstein Llp 2022 Trust And Estates Updates

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

What Is The Tax Free Gift Limit For 2022

How To Make The Most Of The Annual Gift Tax Exclusion Isdaner Company

Gift Tax Limit 2022 What Is It And Who Can Benefit Marca

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Gifting Time To Accelerate Plans Evercore

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

2015 Estate Gift Generation Skipping Tax Exemptions The Ashmore Law Firm P C